3:50:02 PM | 10/6/2024

“Vietnam’s economy showed robust recovery in the first half of 2024 and continued to maintain momentum despite global uncertainties. This steady recovery has been driven by improving industrial production and a strong rebound in trade.”

This statement was made by Mr. Shantanu Chakraborty, ADB Country Director for Vietnam, at a press briefing on the Asian Development Outlook (ADO) September report released in Hanoi recently.

The Asian Development Bank (ADB) projected a positive economic outlook for Vietnam, forecasting its gross domestic product (GDP) growth at 6% in 2024 and 6.2% in 2025.

According to ADB, export-oriented industries remain the main driver of growth. The gradual return of new orders and consumption revived manufacturing growth in the first half of 2024, with further momentum expected for the whole year. The manufacturing purchasing managers’ index edged above 52.4 in August 2024 and continued to expand, indicating a recovery in consumption-led manufacturing. External demand for major electronics exports fueled industrial production. However, subdued global economic prospects left some uncertainty. Industry was forecast to grow by 7.3% in 2024 and expand by 7.5% in 2025. Construction could further pick up if major infrastructure projects could be implemented as planned.

Vietnam's industry is projected to grow by 7.3% in 2024 and 7.5% in 2025

Other sectors were also expected to show modest growth. Services were forecast to continue expanding by 6.6%, supported by revived tourism and the recovery of associated services. In August 2024, retail sales improved by 7.9% year on year, lifting sales in the first eight months of 2024 by 8.5% at current local prices (5.3% in real terms). This growth level remained lower than the 10.3% growth over the same period last year, showing sluggish domestic demand. Agriculture benefited from rising food prices and was expected to expand by 3.4% in 2024.

On the demand side, fiscal expansion and monetary easing will continue to support consumption, which has remained subdued. Public investment will be crucial for economic recovery and growth in 2024. According to ADB, continued fiscal support and substantial state investments will further stimulate demand during the second half of 2024. However, persistent corporate bond issuance will continue to put downward pressure on the property sector, previously a key driver of domestic consumption. Domestic demand is expected to remain relatively weak through 2024-2025

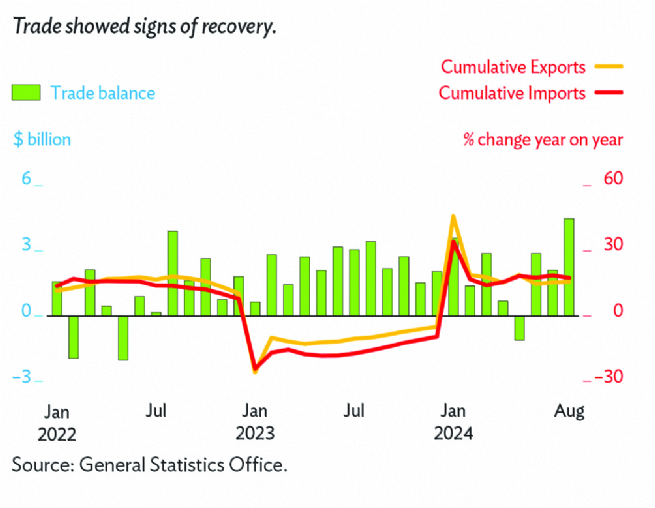

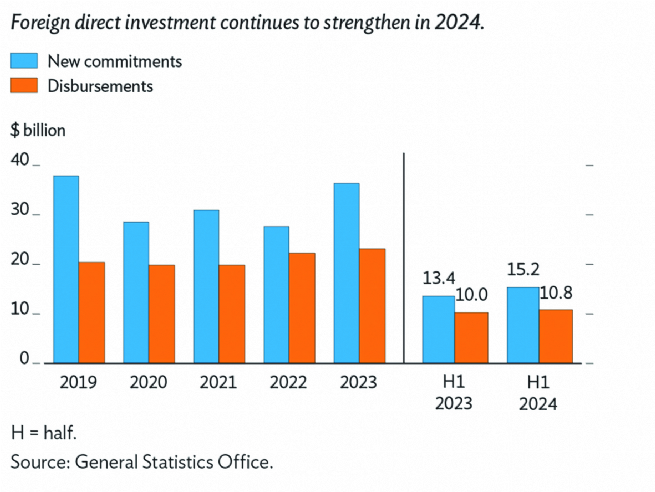

Notably, trade recovery and positive FDI flows will be key growth drivers. The uncertainty of the continued restructuring of global and regional supply chains hampers trade prospects. Imports and exports will likely grow by over 10% this year and slightly higher next year, with the gradual revival of external demand. Robust trade activity was expected to help maintain the current account surplus estimated at around 2% of GDP in 2024. As manufacturing activity revives, pushing up imports of production inputs, the current account balance was projected to narrow to 1.5% of GDP in 2025.

Shipments of mobile phones, computers and electronic products have increasingly contributed to overall export growth. The proportion of these items in total export value has steadily grown. In 2011, they accounted for just 12% of total export turnover. By 2014, this share doubled to 24% and almost tripled to 33% by 2023. The average growth rate of electronics exports from 2011 to 2023 was 26.7%. This robust growth made it the largest export group for Vietnam by 2023, with a value of US$117.3 billion, accounting for 33% of the total export turnover. Additionally, the rise in Vietnam’s electronics exports underscores the global supply chain shift in high-tech products, with the country playing an increasingly significant role.

Despite a modest increase in inflation in the first half of 2024, the inflation projection remains at 4% for both 2024 and 2025. Factors such as wage hikes and government-controlled price adjustments were expected to push inflation upward. However, monetary easing by the United States Federal Reserve (Fed) would help alleviate some inflationary pressure. Coordinated policies are thus crucial to support the economic recovery, considering relative price upticks and weak demand. In the near term, according to ADB, loosening monetary policy must be closely coordinated with implementing fiscal policy to effectively boost economic activity. Monetary policy will pursue the dual objectives of price stability and growth, even as policy space is limited. The heightened risk of nonperforming loans due to the economic down cycle restricts the prospect of additional monetary easing.

Despite optimistic outcomes, there are significant uncertainties on Vietnam’s economic outlook. ADB said, domestically, the real economy continues to show weaknesses in its underlying structural foundations. Domestic demand will require stronger execution of fiscal stimulus measures. Externally, subdued global prospects could further hamper demand, adversely affecting exports, manufacturing activity, and employment. Vietnam’s exports face increasing competition due to trade diversions from global value chain reconfigurations for products, such as garments, textiles and electronics, as well as risks from heightened geopolitical tensions and rising protectionism.

“To maintain growth momentum through 2024 and 2025, preserving macroeconomic stability with a more balanced mix of monetary and fiscal policies is essential, complementing comprehensive governance reforms. Weaker than expected external demand will require further policy measures to boost business activities to stimulate domestic demand,” ADB analyzed.

While the State Bank of Vietnam (SBV) continues to pursue an accommodative monetary policy, its capacity to do so has become significantly constrained. Consequently, there is increased urgency for enhanced fiscal support, increased public investment disbursements, and further reforms in governance to alleviate the burden on monetary policy in bolstering the economy, according to ADB.

By Lan Anh, Vietnam Business Forum